5500Tax Group specializes in employee benefit tax form preparation services, providing an unparalleled tax filing preparation experience for a variety of brokers, plan administrators and businesses. Our tax preparation professionals are well-versed in the complexities of tax law, ensuring that our clients’ filings are on time and accurate. We utilize state-of-the-art filing software and online tax preparation platforms to streamline the process, allowing you to have a hassle-free and efficient tax filing experience.

As a leading employee benefit tax preparation company, we pride ourselves on offering personalized service and support to each of our clients. Our team of professionals is dedicated to staying up to date with the latest tax preparation regulations, ensuring accuracy and compliance. Whether you are a large or small business or a plan administrator seeking assistance with employee benefit form filing, we are here to guide you every step of the way.

Employee Benefit Tax Forms

The 5500Tax Group provides you with the specialized knowledge and attention to have confidence in succeeding with the complexities of employee benefit plan filing and compliance.

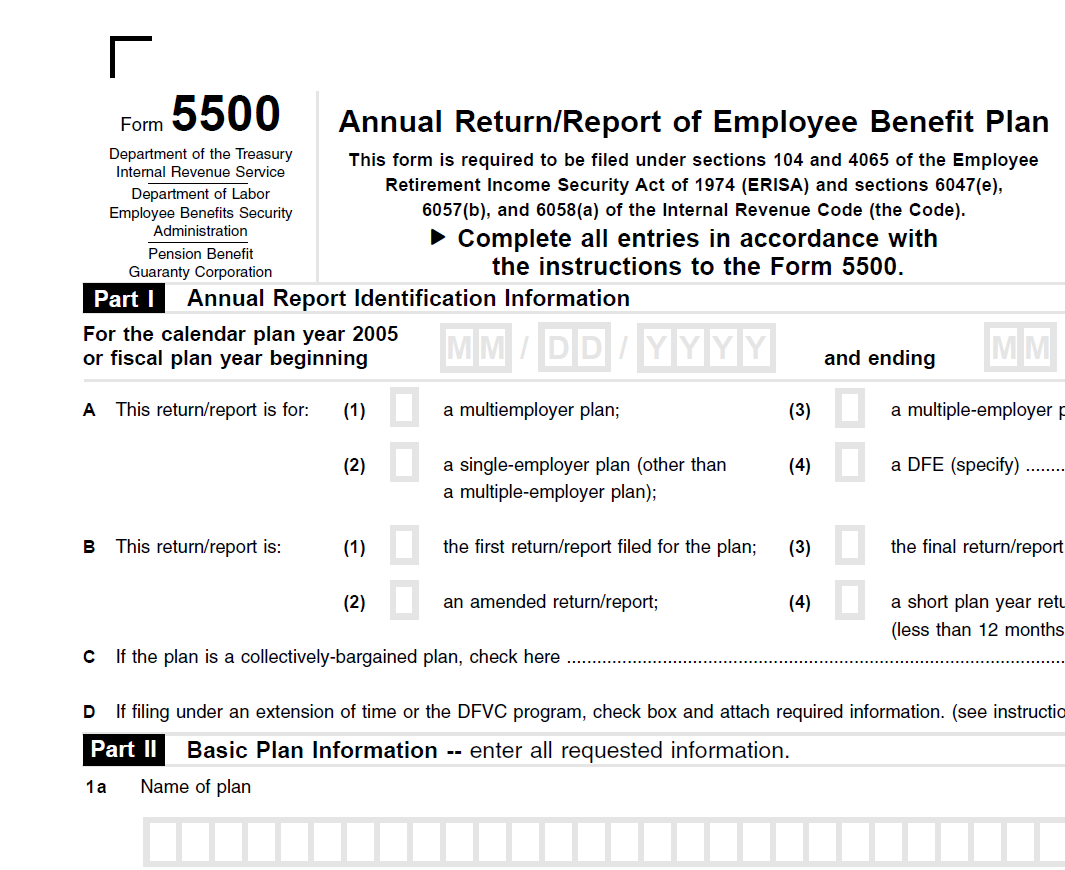

Form 5500

The Form 5500 filing is an annual report that must be filed by employers who sponsor employee benefit plans in the United States. The form is required by the Department of Labor (DOL), the Internal Revenue Service (IRS), and the Pension Benefit Guaranty Corporation (PBGC).

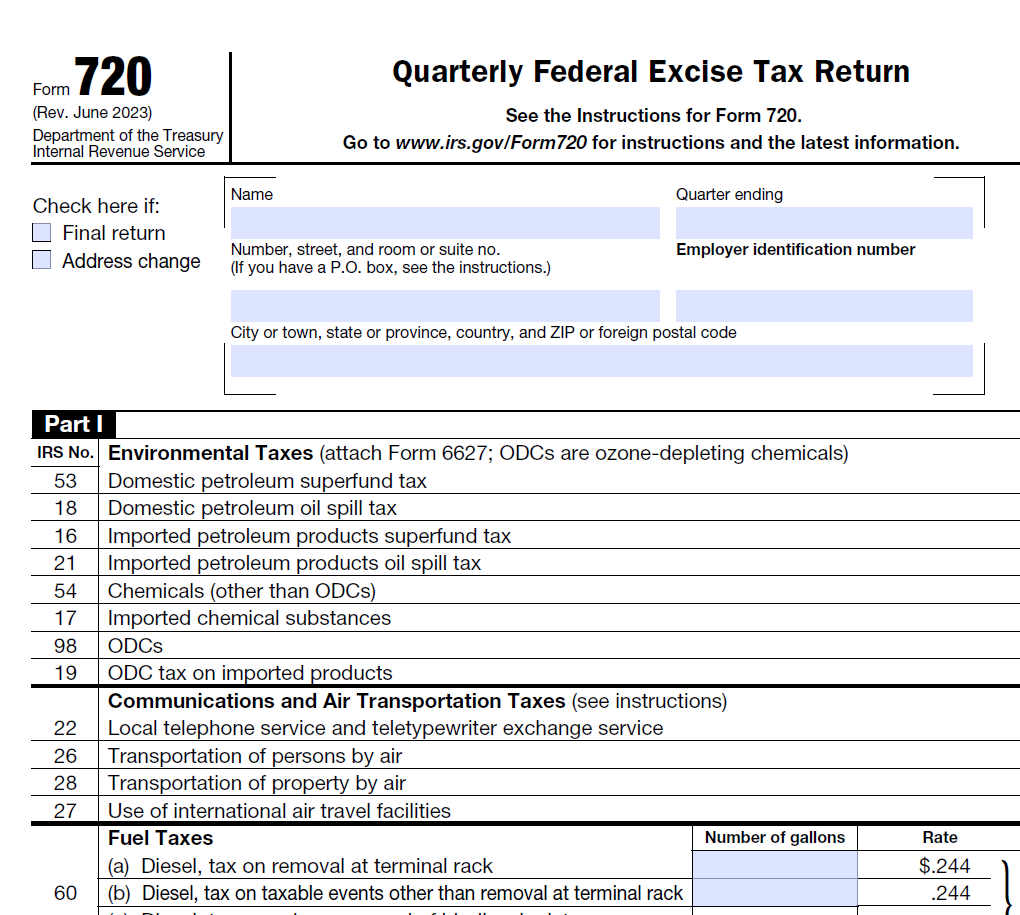

Form 720

In a broad sense, Form 720 is a quarterly excise tax return that businesses must file to report and pay federal excise taxes on certain products or services. However, specifically related to employee benefits, the form includes the Patient-Centered Outcomes Research Institute (PCORI) fee, which was enacted by the Affordable Care Act.

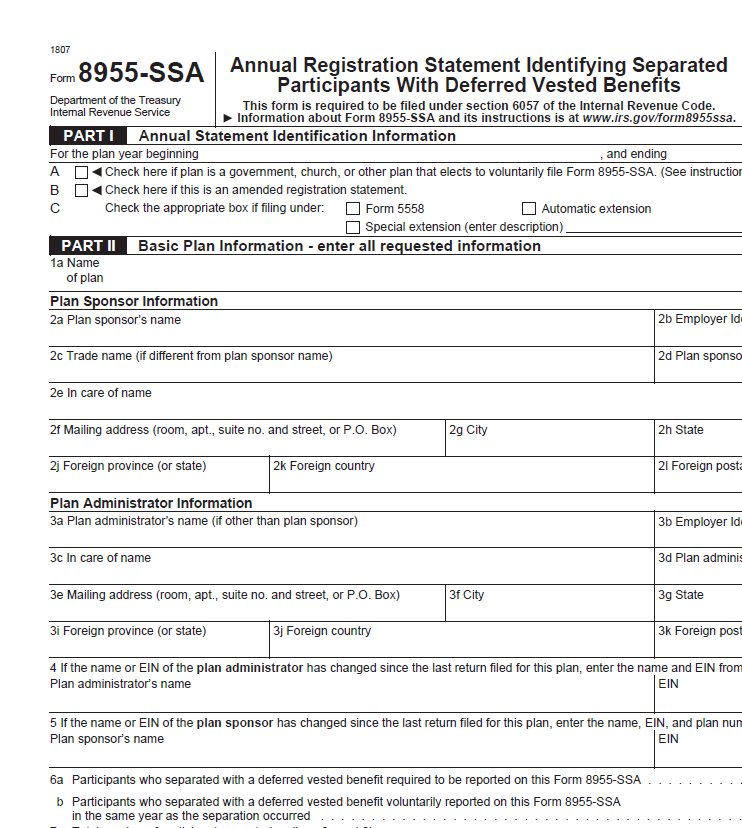

Form 8955-SSA

Form 8955-SSA is an annual report filed by employers to report information about separated participants with deferred vested benefits under their retirement plans. The form is required to be filed by plan administrators or plan sponsors of certain retirement plans subject to the Employee Retirement Income Security Act (ERISA).

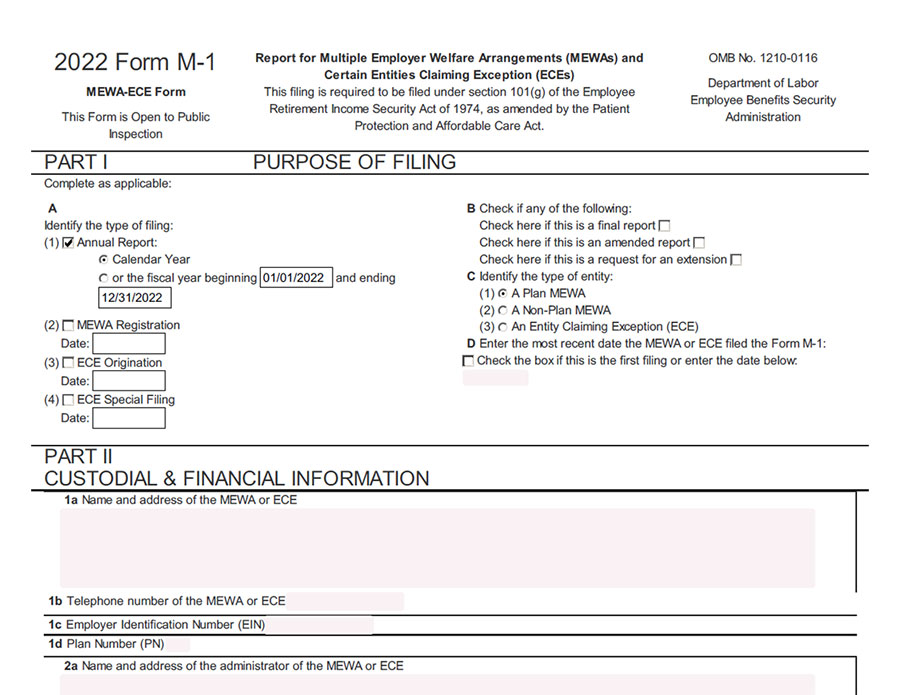

Form M-1

Form M-1 is a report that must be filed annually by Multiple Employer Welfare Arrangements (MEWAs) with the U.S. Department of Labor (DOL). The information on the form provides the DOL with information about the MEWA with the primary purpose to help them monitor MEWAs and ensure that they are operating in compliance with federal law.

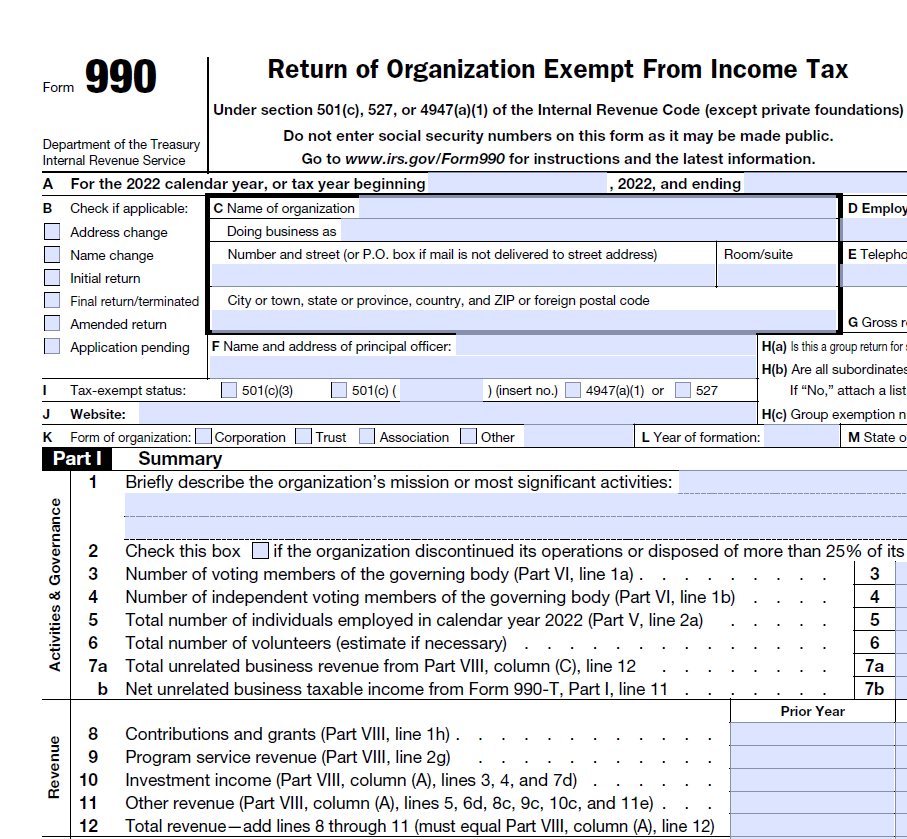

Form 990

Although not a form used to calculate taxes owed by an organization, Form 990, the Annual Exempt Organization Return, is an information return filing that tax-exempt organizations in the United States must file with the IRS. This form provides information about the organization’s finances, including its income, expenses, assets, and liabilities.

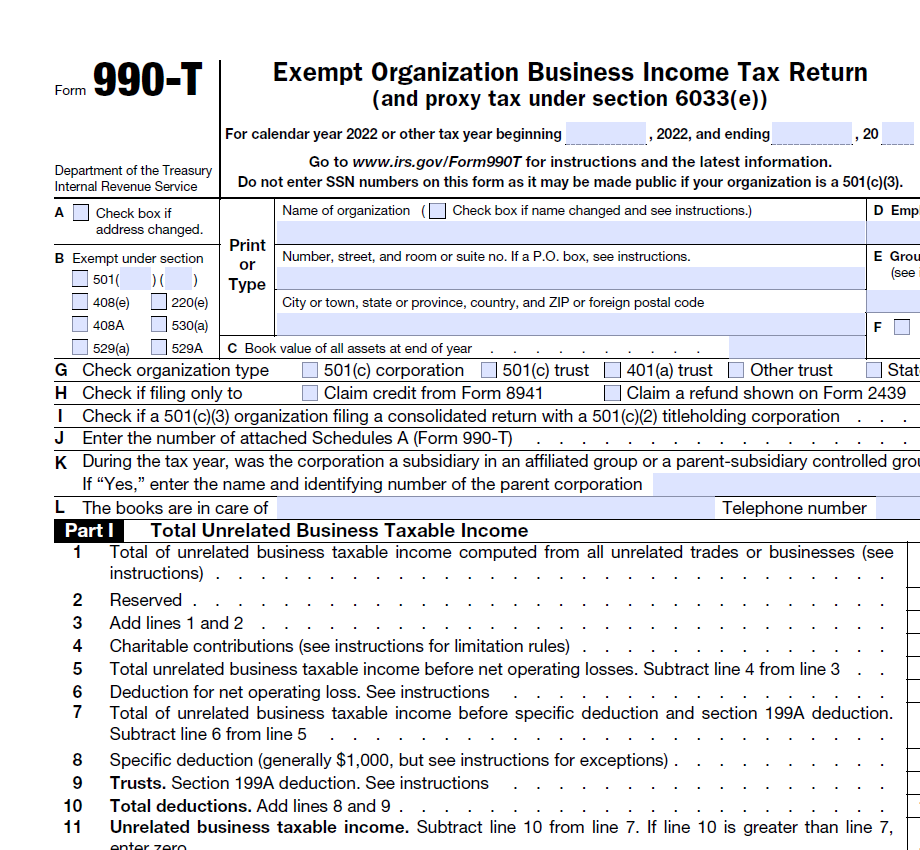

Form 990-T

IRS Form 990-T is a separate tax form that must be filed by exempt organizations that have certain types of unrelated business income and is used to calculate and report tax owed. Although income is typically tax-exempt, if income is generated from activities that are unrelated to their exempt purposes, it may be subject to taxation on that income.

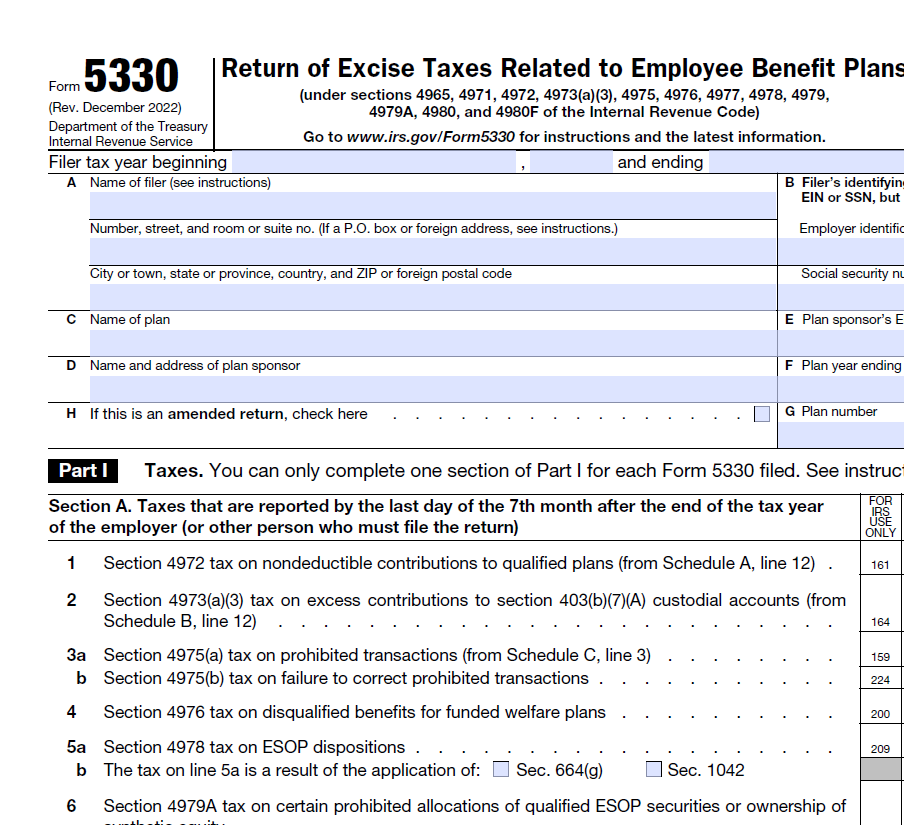

Form 5330

Form 5330 is a tax form used in the United States to report excise taxes on certain transactions and operations within employee benefit plans. Not all employee benefit plans are required to file this form, but in the case of prohibited transactions, funding deficiencies, late funding and excess fringe benefits, they may be.

Wrap Document Preparation

An ERISA Wrap Document is a legal document that combines, or “wraps” together various employee welfare benefit plans offered by an employer to help to comply more easily with the Employee Retirement Income Security Act of 1974. Although Wrap Documents are not required, the primary benefit of considering this service is to streamline the administration of your plan and minimize the risk of overall non-compliance.

Non-Discrimination Testing

Non-discrimination testing services for cafeteria plans are designed to ensure that these plans comply with federal regulations which govern cafeteria plans. Test results evaluate whether the plan is unfairly favoring highly compensated employees (HCEs) or key employees over the rest of the workforce to ensure that all employees have equal access to the benefits offered and meet the required standards.

We Have Answers to All Your Most Common Questions

Here is a list of questions we encounter most often. The answers for you are dependent on your specific situation. Contact us today, so we can develop solutions specifically for you!

FAQs

General 5500

- What is Form 5500?

- Who must file a Form 5500?

- When must Form 5500 be filed?

- Why do I have to file a Form 5500?

- Is an extension of time available to file a Form 5500?

- Who is required to sign Form 5500?

- Are there penalties for not filing Form 5500?

- Are there any exceptions to filing a Form 5500?

- Are there fines for late filing?

- What is ERISA?

- Can I file one Form 5500 for my health and welfare plan and my retirement plan?

Health and Welfare 5500s

- What is a health and welfare benefit?

- What is the purpose of a health and welfare Form 5500?

- Which health and welfare plans must file a Form 5500?

- Which health and welfare plans are exempt from filing a Form 5500?

- Who is considered a participant for health and welfare filings?

- What is Schedule A?

- What is Schedule C?

- What is a Summary Annual Report?

- When is the Summary Annual Report required to be distributed?

- What are the acceptable ways to distribute a Summary Annual Report?

- Can the Summary Annual Report be distributed electronically?

- Do terminated participants need to receive a Summary Annual Report?

- What is a MEWA?

Retirement Plan 5500s

- What retirement plans must file a Form 5500?

- What is the purpose of filing a retirement plan Form 5500?

- What retirement plans are exempt from filing a Form 5500?

- Who is considered a participant in a retirement plan?

- What is the 80/120 rule?

- When can a plan file a 5500-SF?

- What is Schedule H?

- What is Schedule I?

- Do I need an audit?

- What is a Fidelity Bond?

DFVC Fillings

- What does DFVC stand for?

- How does the DFVC program work?

- What are the penalties under the DFVC program?

- Who pays the penalties under the DFVC program?

- How do I pay the penalties under the DFVC program?

- Can I utilize the DFVC program?

Wrap Document Preparation

- What is a “wrap” plan?

- Why would I want to adopt a wrap plan?

- How do you distribute a SPD?

- What are the SPD electronic distribution rules?

Non-Discrimination Testing

- What types of plans need to be tested for non-discrimination?

- When do you run nondiscrimination testing?

Other Forms

Form 720

- What is a PCORI?

- What plans are subject to the PCORI fee?

- When is Form 720 due?

- Is an extension of time available for Form 720?

Form M-1

- What is a MEWA?

- Who must file an M-1?

- When is the M-1 due?

- Is there a fee to be paid with an M-1?

Form 990/990T

- What is Form 990?

- What is Form 990-T?

- When is Form 990 due?

- When is Form 990-T due?

- What is unrelated business taxable income?

- How is unrelated business taxable income taxed?

Form 5330

- What is Form 5330?

- When is Form 5330 due?

- What are prohibited transactions?

- How are prohibited transactions taxed?

Form 8955-SSA

- What plans must file a Form 8955-SSA?

- Which participants must be included on Form 8955-SSA?

- When is the Form 8955-SSA due?

- Is there an extension of time for the Form 8955-SSA?

- What is the purpose of the Form 8955-SSA?

Consulting

Employee benefit and ERISA Consulting

- What are fiduciary responsibilities?

- What are the minimum required distributions for the current plan year?

- What are the COLA limits for the current plan year?

Plan Compliance Audits

- How do we determine how many health & welfare plans need to be filed?

- What are the benefits of a plan compliance audit?

- The DOL is auditing our plan, what do we do?